Navigating the Future of Finance: Trends in Cloud Banking and How to Thrive

The financial world is experiencing a seismic shift with the rise of cloud banking. Agility, innovation, and efficiency are now within reach for banking and financial services firms navigating the digital transformation. Driven by tendencies like AI, mobile banking, and digital currencies, the race to modernize with the cloud is on, even though security and compliance remain top priorities for institutions.This article delves into the hottest of cloud based computing patterns, their impact, and how businesses can navigate this exciting revolution.

The Cloud Beckons: Why Financial Institutions Are Embracing Cloud Migration

Source: Freepik

The winds of change are sweeping through the financial sector, and the destination is clear: the cloud. But what compels financial companies, under the guidance of business leadership, to embark on this transformative journey? Here are some key motivators:

- Regulatory Compliance: Juggling complex regulations can be a costly and time-consuming endeavor. Cloud platforms offer built-in compliance features and automated processes, streamlining adherence and reducing regulatory burdens.

- Enhanced Customer Experience: Customers demand seamless, personalized experiences across all touchpoints. Cloud enables banking and financial services firms to develop and deploy innovative digital solutions quickly, meeting evolving customer needs and expectations.

- Data-Driven Insights: The cloud unlocks a treasure trove of data, empowering banking and financial services firms to gain deeper insights into customer behavior, market trends, and risk management. This data-driven decision-making fuels smarter strategies and competitive advantage.

- Operational Efficiency: Traditional IT infrastructure can be cumbersome and expensive to manage. Cloud offers on-demand scalability, automated provisioning, and simplified maintenance, leading to streamlined operations and cost optimization.

- Innovation Acceleration: The cloud fosters a culture of innovation. Rapid access to cutting-edge technologies like AI, machine learning, and blockchain empowers banking and financial services firms to develop and launch new products and services faster, staying ahead of the curve in a dynamic market environment.

- Competitive Advantage: In today’s digital landscape, responsiveness is paramount. Cloud adoption enables banks to adapt to changing market conditions quickly, outmaneuver competitors, and capture new opportunities.

Beyond the tangible benefits lies a shift in mindset. Embracing the cloud signifies a commitment to agility, innovation, and customer-centricity, positioning banks for long-term success in the digital era. The cloud is no longer a trend; it’s a strategic imperative, and the motivations driving adoption are compelling and clear.

Cloud Adoption in Financial Institutions

The financial sector is witnessing a meteoric rise in cloud adoption, fueled by the need for flexibility, scalability, and innovation. GlobalData reports that retail banks alone spent over $38 billion on cloud computing in 2022, and this market is expected to grow at a compound annual growth rate (CAGR) of more than 22% by 2026. This statistic underscores the significant shift towards cloud adoption within the financial sector.

Source: Freepik

Why this surge?

Cloud computing unlocks a treasure trove of benefits for financial institutions:

- Effortless Scaling: Resources seamlessly adapt to fluctuating workloads, ensuring efficiency and cost-effectiveness.

- Cost Optimization: Eliminating expensive hardware infrastructure frees up resources for core business activities.

- Innovation on Demand: Access to cutting-edge technologies like AI and ML fuels rapid development and time-to-market.

- Enhanced Customer Experience: Cloud empowers financial companies to build and deploy new digital solutions, delighting customers with better engagement and accessibility.

However, the climb to the cloud summit isn’t without its challenges, particularly when dealing with legacy systems. Security and compliance concerns remain paramount, demanding robust measures to safeguard sensitive data and adhere to complex regulations. Additionally, data privacy requires a careful cloud strategy to ensure control and transparency. Finally, vendor lock-in poses a potential risk, limiting flexibility and potentially increasing costs over time.

Despite these hurdles, the path forward in digital transformation is clear: the benefits of cloud adoption far outweigh the challenges. By implementing well-defined strategies and navigating the landscape with a keen eye, financial institutions can harness the power of the cloud to drive flexibility, innovation, and a secure footing in the ever-evolving digital landscape. The future of finance is in the cloud, and those who embrace it will be best positioned to thrive.

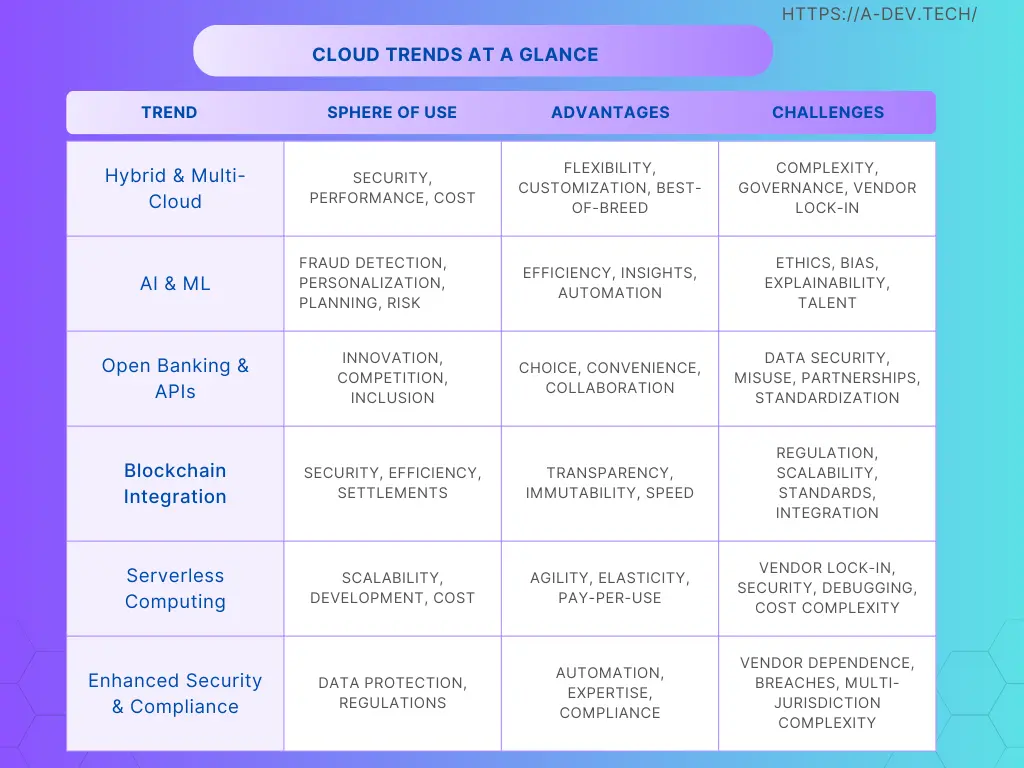

Current Trends in Cloud Banking: A Glimpse into the Future

The financial sector is witnessing a whirlwind of innovation, driven by the rise of cloud banking. However, navigating this dynamic landscape requires careful consideration of both opportunities and challenges. Here’s a closer look at some key trends shaping the future of cloud banking, including advancements in customer relationship management strategies.

Hybrid and Multi-Cloud: Embracing Flexibility and Security

Source: Freepik

Gone are the days of single-cloud dominance. Banks are increasingly adopting hybrid and multi-cloud strategies, combining the public cloud, private cloud, and on-premise environments. This allows them to:

- Leverage best-of-breed solutions: Each cloud provider offers unique strengths. Public clouds like AWS excel in scalability, while private clouds offer enhanced security for sensitive financial data.

- Optimize costs: Allocate workloads based on cost and performance requirements, maximizing resource utilization and minimizing unnecessary spending.

- Enhance security: Distribute data and applications across diverse platforms, making it more difficult for attackers to gain access.

However, this flexibility comes with challenges. Managing multiple cloud environments adds complexity and requires robust governance strategies. Implementing cloud technologies like containers and serverless computing can help organizations streamline management and enable seamless portability across different cloud platforms.

AI/ML: Transforming the Customer Experience

Artificial intelligence and machine learning (AI/ML) are revolutionizing financial services. From fraud detection and risk management to personalized experiences and automated financial planning, AI/ML is unlocking new possibilities. A cloud platform provides the scalability and power necessary to handle massive amounts of data and run complex algorithms, driving digital transformation at an unprecedented pace.

However, integrating AI/ML responsibly within consumer banking requires careful consideration of ethical implications and potential bias in algorithms. Additionally, robust security measures are crucial to protect data used for AI/ML training and deployment.

Open Banking and APIs: Encouraging Cooperation and Ingenuity

Open banking APIs are breaking down barriers and unlocking cooperation between financial institutions and third-party providers. This fosters the development of:

- New financial products and services: Fintech partnerships enable banks to offer customized solutions for diverse customer needs, ranging from niche investment options to innovative payment solutions.

- Improved access and convenience: Open APIs streamline integration with third-party apps, allowing customers to manage their finances seamlessly across different platforms, creating a richer and more convenient user experience.

However, data privacy remains a primary concern. Banks and organisations need to ensure secure and controlled data sharing practices while remaining compliant with regulations. Implementing strong authentication and access control mechanisms is crucial to mitigate risks.

Blockchain Integration: Streamlining Transactions and Enhancing Security

Blockchain technology holds immense potential for the financial sector. Its ability to automate tasks and reduce costs in areas like trade finance and cross-border payments makes it a game-changer. Additionally, its immutability safeguards sensitive information and upholds industry standards by providing a tamper-proof record of transactions, reducing fraud risk.

However, widespread adoption necessitates overcoming issues such as scalability, energy consumption, and regulatory uncertainty. Cloud platforms can provide the infrastructure and scalability needed to explore and implement blockchain solutions, but interaction with regulators and industry stakeholders is crucial for developing clear guidelines and standards.

Serverless Computing: Pay-as-You-Go Efficiency

Serverless computing allows banks to run code without managing servers, reducing operational complexity and costs. This pay-per-use service model is ideal for scaling capacities up or down based on demand, particularly for tasks with fluctuating workloads.

However, vendor lock-in can be a concern if a bank is relying on a single provider. Banks should carefully evaluate their needs and choose providers that offer flexibility and open standards to avoid being tied to one platform.

The cloud banking landscape is evolving at a rapid pace. These disruptive trends highlight the potential for increased responsiveness and security. By understanding their impact and embracing relevant technologies while carefully addressing challenges, financial companies and banks can position themselves for a secure and successful outcome in the digital era.

Optimizing Cloud Computing Strategies for Financial Institutions

Source: Freepik

Embracing the cloud isn’t a one-size-fits-all journey. Tailoring your cloud strategy to individual needs and goals is crucial for maximizing its impact. Here are key considerations to navigate the landscape:

1. Security and Compliance: Fort Knox in the Cloud

Security and compliance are non-negotiable. Implement robust security measures like encryption, access controls, and threat detection systems. Partner with cloud providers offering SOC 2 and HIPAA compliance certifications for added assurance. Remember, the cloud isn’t inherently less secure; it’s how you utilize it.

2. Data Governance: Mapping Your Cloud Assets

Data governance becomes paramount in the cloud. Establish clear policies and procedures for data access, usage, and retention. Leverage data discovery and classification tools to understand your data landscape and prioritize sensitive information for enhanced protection.

3. Cost Management: Optimizing the Cloud Dollar

The cloud offers pay-as-you-go flexibility, but vigilance is key. Monitor cloud resource usage and implement cost optimization strategies like reserved instances, auto-scaling, and spot instances for unused resources. Utilize cloud cost management tools for granular insights and optimization opportunities.

4. Vendor Selection: Choosing Your Cloud Partner

In the financial services sector, selecting the right cloud provider is critical. Evaluate different options based on your needs, security posture, compliance requirements, and budget. Consider multi-cloud solutions to utilize specialized strengths from different providers and avoid vendor lock-in.

Tech Insights for Enhanced Optimization

- Leverage containerization: Package applications in portable containers for seamless portability and management across diverse cloud environments.

- Implement serverless computing: Pay only for the resources used, enabling efficient scaling and cost management.

- Harness AI and machine learning: Optimize resource allocation, predict workload demands, and identify security threats in real-time.

- Utilize cloud-native security solutions: Benefit from built-in security features and threat detection capabilities offered by cloud providers.

Best Cloud Technology Practices for Success

- Adopt a phased approach: Start small, pilot in non-critical areas, and gradually expand based on experience and learnings.

- Build talent expertise: Invest in training and development programs to equip your team with the necessary cloud skills and knowledge.

- Embrace a culture of innovation: Experiment, measure, and learn continuously to optimize your cloud journey and unlock its full potential.

By meticulously planning, prioritizing data protection and regulatory adherence, and leveraging emerging technologies, a financial institution can navigate the cloud with confidence and “…embrace a journey of continuous improvement, customer-centric solutions, and sustainable growth.Remember, the cloud is a powerful tool, but it’s your strategy that determines its value and growth.

Cloud Banking's Revolution: A-Dev Paves Your Path to Success

Source: Freepik

The cloud is no longer a passing fad in the financial industry; it’s a seismic shift transforming the way banks operate. Hybrid/multi-cloud architectures, AI/ML adoption, and open banking unlock incredible potential for increased flexibility, enhanced data protection, and unwavering regulatory compliance. While navigating this dynamic landscape presents challenges, the benefits of cloud computing far outweigh the hurdles.

- Seamless customer experiences: Deliver personalized, frictionless interactions driven by cloud-powered agility and creativity.

- Data-driven decisions: Utilize A-Dev’s expertise to harness the potential of your information, gaining deeper insights for informed decision-creation.

- Optimized operations: Streamline processes, eliminate inefficiencies, and optimize costs with A-Dev’s comprehensive cloud management solutions.

Collaboration is essential. A-Dev fosters a collaborative environment, working closely with you to tailor a cloud strategy aligned with your unique needs and goals. We don’t just migrate you to the cloud; we guide you every step of the way, ensuring a smooth and successful journey.

Remember, the cloud is a continuous evolution, not a one-time destination. A-Dev empowers you to adapt and grow continuously, providing ongoing support and expert guidance to maintain your competitive edge in the ever-evolving digital landscape.

Embrace the cloud’s transformative power with A-Dev. Contact us today and explore how our personalized solutions can unlock your bank’s true potential.